The form should be submitted every. Malaysia was the first country to issue biometric.

The rate of excise duties vary from a composite rate of MYR 110 per litre and 15 of the value for certain.

. There are two types of taxable income for Spanish PIT purposes. The cost varies depending on the number of pages and the validity of the e-passport. Corporations making payments of the following types of income are required to withhold tax at the rates shown in the table below.

Business losses can be set off against income from all sources in the current year. US150 with all taxes included. Malaysia also has a reported critical occupations list COL highlighting job types where there is a skills shortage within the country that supports work permitsvisa applications.

Malaysia has no WHT on dividends in addition to tax on the profits out of which the dividends are declared. The e-passport is valid for either five years or. Top ten developers BCI Asia.

Thailands most updated English news website thai news thailand news Bangkok thailand aecnewspaper english breaking news. Maintain good records relating to your rental activities including the rental income and the rental expenses. You must be able to document this information if your return is selected for audit.

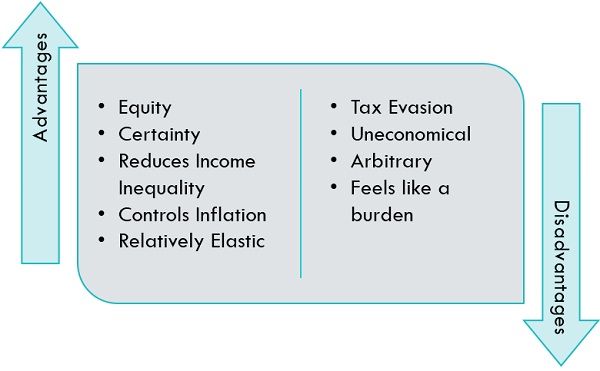

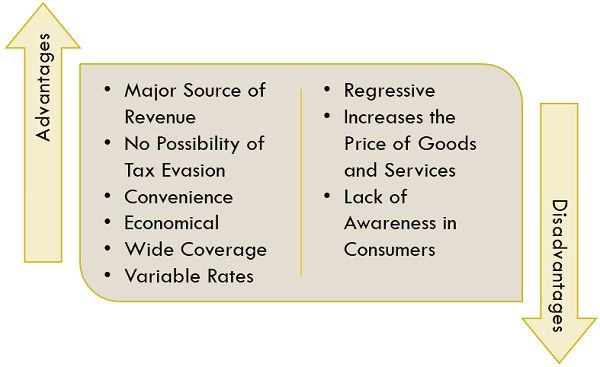

You pay some of them directly like the cringed income tax corporate tax wealth tax etc while you pay some of the taxes indirectly like sales tax service tax value added tax etc. The implementation of both taxes differs. But it is essential to know that complex goods-specific rules still exist specifically how it relates to duties and taxes and how it can affect custom clearance in Malaysia.

An operating lease is a contract that allows for the use of an asset but does not convey rights of ownership of the asset. Malaysias tariff barriers are largely applied ad valorem ranging from 0 to 50. In a broader term there are two types of taxes namely direct taxes and indirect taxes.

In Malaysia there are three work permitvisa types. Detailed description of other taxes impacting corporate entities in Malaysia. Service tax is a consumption tax levied and charged on any taxable services provided in Malaysia by a registered person in carrying on ones business.

The form must be submitted on the 10th calendar date after the month the tax has been withheld. Top ranked developer The Star Property. All TWAs are required to remit taxes monthly using BIR Form 0619E.

Malaysia Corporate - Withholding taxes Last reviewed - 13 June 2022. Not a separate legal entity unlimited liabilities at personal capacity of business owners. The value of labour -power constitutes the conscious and explicit.

You can find their projects all over Malaysia especially in the Klang Valley Ipoh Penang and Johor. Your tax authority may have the power to issue a summons for you to appear and provide information related to your taxes. Malaysias custom tariffs are typically imposed on a value-add basis with a simple average applied tariff of 61 for industrial goods.

The federal rate ranges from 06 to 6 depending on how much the employer pays in state unemployment tax. Double taxation is a taxation principle referring to income taxes paid twice on the same source of earned income. Typically only employers pay unemployment taxes but in a few states employees also contribute.

Import taxes and customs duties. Weve developed a suite of premium Outlook features for people with advanced email and calendar needs. Administrative summons can be issued by different types of administrative courts such as.

They also have completed projects in other countries like Singapore and China. One of the most concerning compliances that many entrepreneurs face is taxes as required by the Inland Revenue Board LHDN and the. The Government of Bangladesh issues three different types of e-passports.

A Microsoft 365 subscription offers an ad-free interface custom domains enhanced security options the full desktop version of Office and 1. An operating lease represents an off-balance sheet. Own partner contribution.

Taxes on income are generally not deductible whereas indirect taxes are deductible. All customs duties and taxes imposed must have been paid before the goods are imported. Since the publication of the History of Trade Unionism 1894 by Sidney and Beatrice Webb the predominant historical view is that a trade union is a continuous association on wage earners for the purpose of maintaining or improving the conditions of their employment Karl Marx described trade unions thus.

Some treaties provide for a maximum. Utilisation of carried-forward losses is. Savings taxable income is basically composed of the following.

Price subject to the hotel conditions period and availability. Approximately 75 of imports into Malaysia are not subject to customs duties. General taxable income and savings taxable income.

If you are audited and cannot provide evidence to support items reported on your tax returns you may be subject to additional taxes and penalties. It can occur when income is taxed at both the corporate level and personal level. It is a testament to her service and duty that the traditional Labour movement is as devoted to the monarchy as anyone else.

When prices do not include all taxes the relevant taxes VAT and touristcity tax will be stated in the forthcoming stages of the reservation. Dividends and other income generated from holding interests in companies. Interest and other income generated from transferring the taxpayers own capital to third.

How to calculate federal payroll tax withholdings. An audit is an objective examination and evaluation of the financial statements of an organization to make sure that the records are a fair and accurate representation of the transactions. Malaysia import duties and taxes.

Registration of Business ROB Registration of Business Act 1956 only applicable for West Malaysia Sole Proprietorship Partnership. Registration of Company ROC Companies Act 2016. An employment pass a professional visit pass and a temporary employment pass.

What forms are required for submitting withholding taxes. A casino is a facility for certain types of gamblingCasinos are often built near or combined with hotels resorts restaurants retail shopping cruise ships and other tourist attractions. These are diplomatic passports.

Depending on the country these prices may not include taxes may include VAT only or may include all taxes VAT and touristcity tax. Running your business as a separate legal entity through a private limited company provides you with benefits such as personal financial security and access to funding but it also requires compliance with laws and regulations in Malaysia. Malaysias best managed property PropertyGuru.

For example every jurisdiction will have a tax authority in charge of handling all matters related to taxes. The Queen was a hero to the working class on Left and Right. Unlike the flat rate FICA taxes calculating federal income taxes is a little more complex.

Some casinos are also known for hosting live entertainment such as. Those who pay their taxes online can file up to the 15th of the month.

Income Tax Law Changes What Advisors Need To Know

Updated Guide On Donations And Gifts Tax Deductions

Cheap And Effective Web Hosting Solutions Tax Deadline Types Of Taxes Self Assessment

We Asked Malaysians About How They Manage Day To Day Financial Responsibilities While Achieving Long Te Types Of Taxes Financial Responsibility Financial Goals

Important Things In Your Payslips Need To Check Payroll Template National Insurance Number Payroll Software

Malaysia Sst Sales And Service Tax A Complete Guide

Individual And Corporate Tax Reform

Canadian History Activboard Activities Resources Amp Amp Lesson Plans Teachers Pay Teachers Social Studies Ccss Math Canadian History

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Joint And Separate Assessment Acca Global

What Is Permanent Establishment A Simplified Guide Velocity Global

6 Income Tax Faq 大马个人所得税需知 Income Tax Income Tax Return Online Taxes

Difference Between Direct Tax And Indirect Tax With Types Advantages And Disadvantages And Comparison Chart Key Differences

Create The Perfect Design By Customizing Easy To Use Templates In Minutes Easily Convert Your Image Designs Into Vid Tax Preparation Tax Refund Tax Accountant

Difference Between Direct Tax And Indirect Tax With Types Advantages And Disadvantages And Comparison Chart Key Differences

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)

Taxes Definition Types Who Pays And Why

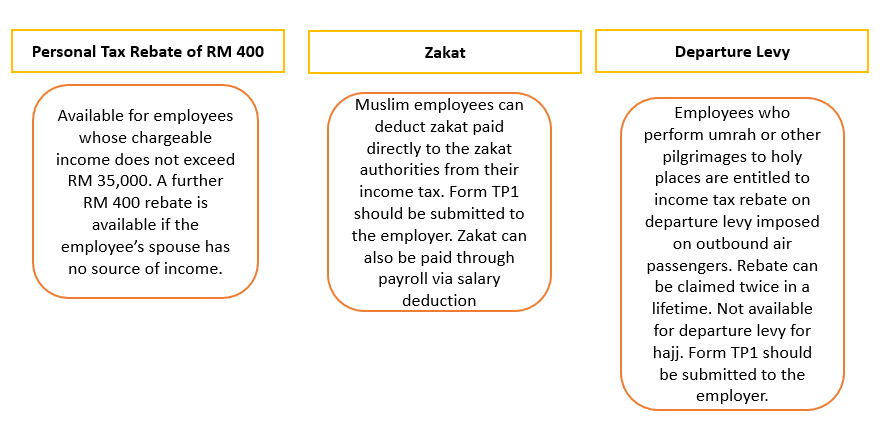

Everything You Need To Know About Running Payroll In Malaysia

/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)